A leading reinsurance hub in Europe

Luxembourg is the largest captive reinsurance market in the EU. International companies from all over the world have established around 200 reinsurance undertakings in the Grand Duchy.

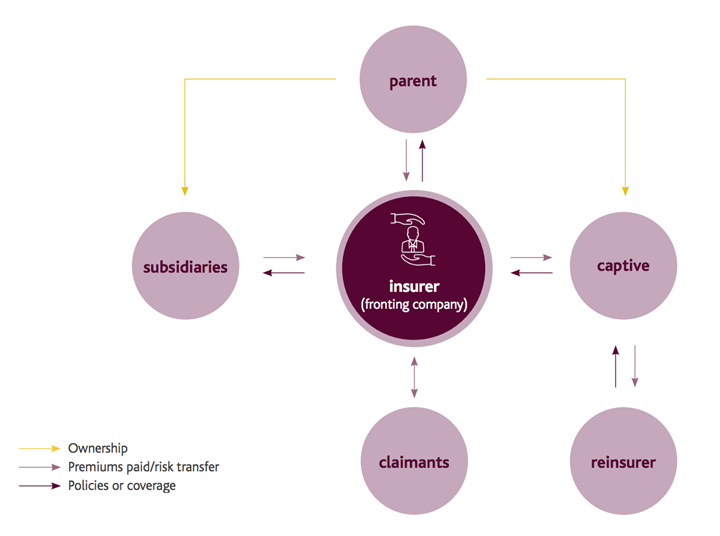

There are several benefits of captive reinsurance. The premiums paid to the captive by the parent and affiliates of the group and the attached captive’s underwriting profits can be retained within the international group and used to finance the business activities of the other subsidiaries of the group.

The captive reinsurance, being an “in-house” reinsurance solution, allows its owner to tailor the insurance to suit the group’s specific requirements. In particular, international groups with different types of risks in different geographic locations may often have to purchase insurance policies from local providers. A captive can create a “one-stop shop” within the group, enabling the owner of the captive to allocate deductibles for each risk or territory.

The captive also centralises the risk management strategy of the international group, allowing for a better overall assessment of the group’s risk exposure and losses.

INSURANCE:

A LEADING FINANCIAL CENTRE IN EUROPE

-

A LEADING FINANCIAL CENTRE IN EUROPE

The Luxembourg financial centre provides a wide range of financial services, acting as a bridge between global investors and markets.

Read More -

INSURANCE IN LUXEMBOURG

The insurance sector in Luxembourg has grown hand in hand with Luxembourg’s financial centre, benefiting from its political, economic and fiscal stability and a triple-A rating from all major rating agencies.

Read More -

LUXEMBOURG LIFE INSURANCE

Luxembourg is the leading financial centre for the distribution of cross-border life insurance products in the Eurozone.

Read More

-

LUXEMBOURG NON-LIFE INSURANCE

With more than 11 billion euros of direct collected premiums in the international non-life sector, Luxembourg recorded unprecedented growth of +240% in 2019.

Read More -

LUXEMBOURG REINSURANCE

Luxembourg is the largest captive reinsurance market in the EU. International companies from all over the world have established around 200 reinsurance undertakings in the Grand Duchy.

Read More -

FUTURE CHALLENGES FOR THE INSURANCE INDUSTRY

From digitalisation to sustainability, increasing customer expectations and new competitors, the insurance sector stands on the precipice of profound change.

Read More